Bitcoin at new record high

Good morning, and welcome to our live coverage of business, economics and financial markets.

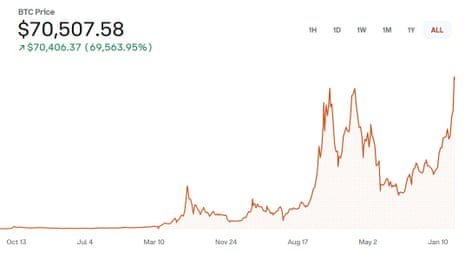

Bitcoin went through a deep “crypto winter” after hitting its previous heights, but after a remarkable rally it is now hitting new heights above $71,000.

The cryptocurrency on Monday morning UK time hit a record of $71,209, adding further to a rally from less than $16,000 in late 2022.

The price of bitcoin had surged to a record of $68,550 in November 2021 amid euphoria from retail investors – many of whom had received money to help them through the coronavirus pandemic lockdowns. Historically low interest rates were also thought by many economists to have helped drive the price higher.

The crypto winter meant that many of the same investors who had piled in to the cryptocurrency were burned. However, institutional investors have shown increasing interest in the biggest cryptocurrency by market value after the US regulator approved new bitcoin exchange-traded funds (ETFs).

Elliott drops Currys takeover approach

In UK corporate news, mid-sized electronics retailer Currys appears to have fended off interest from US private equity investors Elliott Advisors.

Currys on Monday reported that Elliott had declined to make a formal offer after its approaches were rejected by the retailer’s board.

International private equity investors have targeted UK companies, which are undervalued compared to their peers on many metrics.

In a statement to the stock market, Elliott said:

Elliott Advisors (UK) Limited, acting on behalf of the funds it advises confirms that, following multiple attempts to engage with Currys’ Board, all of which were rejected, it is not in an informed position to make an improved offer for Currys on the basis of the public information available to it. Elliott therefore confirms it does not intend to make an offer for Currys.

Under the UK’s takeover rules, Elliott will be unable to make a new bid for Currys for at least six months (unless it gains the approval of the Currys board or there is a change in circumstances).

The agenda

Key events

Reddit seeks $6bn valuation in New York stock float

Social network Reddit is hoping for a valuation of as much as $6.4bn when it floats shares on the New York stock exchange.

Reddit said it will sell 22m shares valued at between $31 and $34 each, in a filing published on Monday.

The social network is one of the most popular forums for online culture, with “subreddits” on a huge array of topics. However, it is still lossmaking – it lost $90m in 2023.

The listing will not be Reddit’s first run-in with financial markets. One subreddit, r/wallstreetbets, was behind a huge surge in market volatility in early 2021 when retail investors banded together to ruin hedge funds shorting various companies, including retailer GameStop and cinema chain AMC Entertainment.

It will be intriguing to see if Reddit itself becomes a target of those same retail investors. The company is certainly aware of the risks: it said r/wallstreetbets could cause “exteme volatility:

Advance Magazine Publishers is the company’s largest shareholder, with a 30.1% stake, while the Chinese multinational Tencent has 11%.

The biggest European stock markets are all in negative territory (with the smaller exception of Switzerland).

The FTSE 100 in London is down by 0.4%, with mining companies the biggest losers.

UK to allow creation of cryptocurrency-backed investments – for pros only

The UK’s financial regulator has said it will allow the creation of cryptocurrency debt instruments on financial exchanges – but only for professional investors.

The Financial Conduct Authority (FCA) said on Monday that it “will not object to requests from recognised investment exchanges to create a UK listed market segment for cryptoasset-backed exchange-traded notes (ETN)”.

The London Stock Exchange today outlined the process for admitting a crypto ETN. It said any new products would need to be “physically backed, i.e., non-leveraged; (b) has a market price or other value measure of the underlying that is reliable and publicly available; and (c) has bitcoin or ethereum underlying cryptoassets.”

The limit to professional investors only is there because the FCA believes that cryptocurrency products “are ill-suited for retail consumers due to the harm they pose”. Those harms are mostly in the form of steep losses for people who piled into crypto – a renewed risk with bitcoin back at a record high. The FCA said:

The FCA continues to remind people that cryptoassets are high risk and largely unregulated. Those who invest should be prepared to lose all their money.

But even if it is not exactly a ringing endorsement from the FCA, it does add to the sense that the long-awaited “institutionalisation” of cryptocurrency – the increasing interest from big banks and investors – is gaining some momentum.

There is something of a health trend in the UK inflation basket update.

Air fryers use less oil (and less energy) to cook, while spray oil for cooking can have lower calories. The further addition of gluten-free bread and rice cakes (thanks to its “growing popularity as part of a healthier lifestyle”) suggests more people are watching what they eat.

Another removal from the UK inflation basket: draught stout. That is because of its apparent similarity to draught bitter. However, before the Office for National Statistics starts a beer connoisseur turf war, we should note that the similarity is limited to price movements.

Bakeware is out for a similar reason: roasting tin prices move in a similar way to frying pans.

Vinyl and air fryers replace hand sanitiser and bakeware in UK inflation basket

The UK “shopping basket” used to calculate inflation has had its annual update. Out: pandemic-era hand sanitiser. In: air fryers, and a stunning return for the vinyl record.

The Office for National Statistics (ONS) tries to make the basket as representative as possible of the typical shopper’s habits to try to get the most accurate gauge of inflationary pressure. That means that the basket ends up being a good way of tracking the changing tastes of British consumers.

Additions: air fryers, vinyl music, gluten free bread, and edible sunflower seeds.

Removals: hand hygiene gel, hot rotisserie cooked chicken, and bakeware.

It is not just vinyl that represents a comeback for physical media despite digital dominance: a card game has been added to the basket as well.

And a hint at a future inclusion related to the rise of the electric car:

We also considered adding electric car charging at public sites to the basket but decided against for this year. We will continue to monitor it with a view to introducing it in future.

You can read the full report from the Guardian’s Phillip Inman here:

Side note: this intro sounds like a bid for the next office karaoke:

Not since Simply Red’s album Stars topped the album charts in 1992 have vinyl records been included in the basket of goods used to calculate annual inflation, but a surge in sales over recent years has brought them back as a marker of UK shop prices.

The European Commission’s use of Microsoft email and office software broke its own privacy rules, an EU privacy watchdog has ruled.

Microsoft’s software transferred personal data outside the EU, breaching privacy rules, according to the European Data Protection Supervisor.

The investigation started in 2021, amid concerns that the flow of personal data to other countries when people use big tech services with servers abroad. The watchdog has ordered the European Commission, the EU’s executive arm, to stop all flows of data to countries that do not meet EU privacy standards by 9 December.

It sounds like that will be a pretty significant job: the infringements “concern all processing operations carried out by the commission, or on its behalf, when using Microsoft 365, and impact a large number of individuals.”

Jack Simpson

Big news in the markets today for any train model enthusiasts out there, as Hornby confirms it has bought Corgi Model Club.

The deal will see Hornby acquire the Corgi subscription service from investment vehicle Blue 14, which is owned by entrepreneur Jim Lewcock.

CMC was established in 2021 as a monthly subscription model and has grown to have more than 6,000 members, and revenues of more than £2m. It supplies re-issued diecast models that were produced from the famous Corgi factory in Swansea during the 1960s.

The deal will see Hornby pay £400,000 for existing stock, and an additional £200,000 for the company, with the CMC management team transferring over. Lewcock has also agreed performance-related earnout based on profitability over the next three years.

The biggest UK stock market drop this morning is from Vanquis Bank: it is down 38% after a profit warning.

Vanquis Bank was formerly known as Provident Financial, but it dropped the 140-year-old name in January last year as it moved away from the doorstep lending that made it into a UK household name.

You can see something of the decline that the former “Provi” has been through in recent years. The steep 38% decline this morning barely registers compared with the tale of woe that is the lender’s share price since 2016:

Vanquis now focuses on credit cards, but it said that 2024 will be worse than expected, in a statement to the stock market:

The group expects to return to modest lending growth from the start of the second quarter. However, income is expected to be materially lower than market consensus expectations for 2024.

Currys shares drop 11% after Elliott Advisors walks away

The share price of Currys has dropped by 11% after the end of an approach by private equity investor Elliott.

Currys was valued at £728m on Friday, so the Monday morning move has wiped about £80m from the company’s notional value.

There will be no bid battle to drive a juicy takeover premium for shareholders in the FTSE 250 company – for now at least.

Chinese online retailer JD.com has also expressed interest. It has another week to make a firm offer or to walk away.

European stock markets are in the red at the open this morning.

They are following the lead of Asian markets, which have slumped. Japan’s Nikkei benchmark index dropped by 2.2% after computer chip stocks fell, after US rivals dropped on Friday.

Here are the opening European stock market snaps from Reuters:

-

EUROPE’S STOXX 600 DOWN 0.4%

-

BRITAIN’S FTSE 100 DOWN 0.4%

-

FRANCE’S CAC 40 DOWN 0.5%, SPAIN’S IBEX DOWN 0.3%

-

EURO STOXX INDEX DOWN 0.6%; EURO ZONE BLUE CHIPS DOWN 0.7%

-

GERMANY’S DAX DOWN 0.6%

Bitcoin at new record high

Good morning, and welcome to our live coverage of business, economics and financial markets.

Bitcoin went through a deep “crypto winter” after hitting its previous heights, but after a remarkable rally it is now hitting new heights above $71,000.

The cryptocurrency on Monday morning UK time hit a record of $71,209, adding further to a rally from less than $16,000 in late 2022.

The price of bitcoin had surged to a record of $68,550 in November 2021 amid euphoria from retail investors – many of whom had received money to help them through the coronavirus pandemic lockdowns. Historically low interest rates were also thought by many economists to have helped drive the price higher.

The crypto winter meant that many of the same investors who had piled in to the cryptocurrency were burned. However, institutional investors have shown increasing interest in the biggest cryptocurrency by market value after the US regulator approved new bitcoin exchange-traded funds (ETFs).

Elliott drops Currys takeover approach

In UK corporate news, mid-sized electronics retailer Currys appears to have fended off interest from US private equity investors Elliott Advisors.

Currys on Monday reported that Elliott had declined to make a formal offer after its approaches were rejected by the retailer’s board.

International private equity investors have targeted UK companies, which are undervalued compared to their peers on many metrics.

In a statement to the stock market, Elliott said:

Elliott Advisors (UK) Limited, acting on behalf of the funds it advises confirms that, following multiple attempts to engage with Currys’ Board, all of which were rejected, it is not in an informed position to make an improved offer for Currys on the basis of the public information available to it. Elliott therefore confirms it does not intend to make an offer for Currys.

Under the UK’s takeover rules, Elliott will be unable to make a new bid for Currys for at least six months (unless it gains the approval of the Currys board or there is a change in circumstances).